India revises double taxation treaties, cause of concern for fintech and ecommerce?

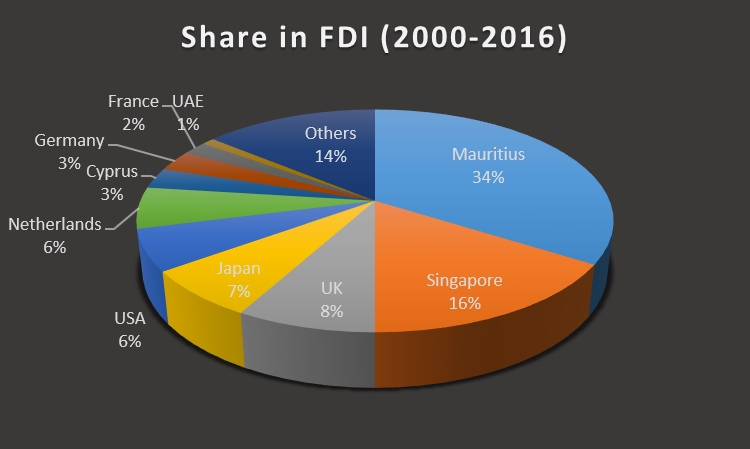

For nearly 30 years, India’s double taxation avoidance agreement (DTAA) with Mauritius came in handy for investors to route money through ‘shell’ companies based out of the island nation. These investors saved on capital gains tax liabilities in Mauritius which does not impose these taxes on off-shore entities. A similar…