Ecommerce companies in India embracing UPI for Payments

Ecommerce major Flipkart’s acquisition of UPI based startup PhonePe Internet Pvt Ltd shows that the payment space is heating up at a rapid pace. Incidentally PhonePe, the Bengaluru based startup was launched by three former Flipkart executives just four months back, and is focusing on peer to peer payments, bill payment and merchant payments- areas of interest for ecommerce companies.

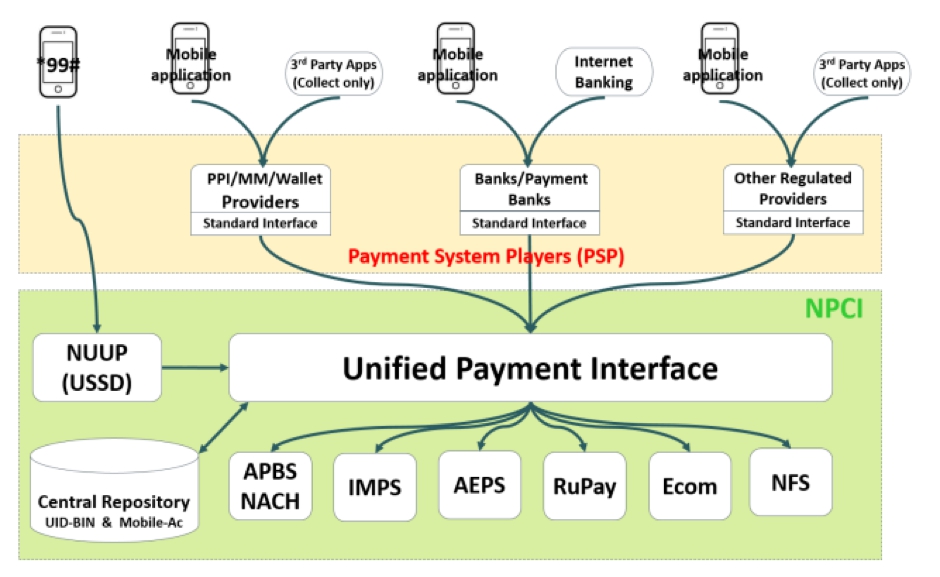

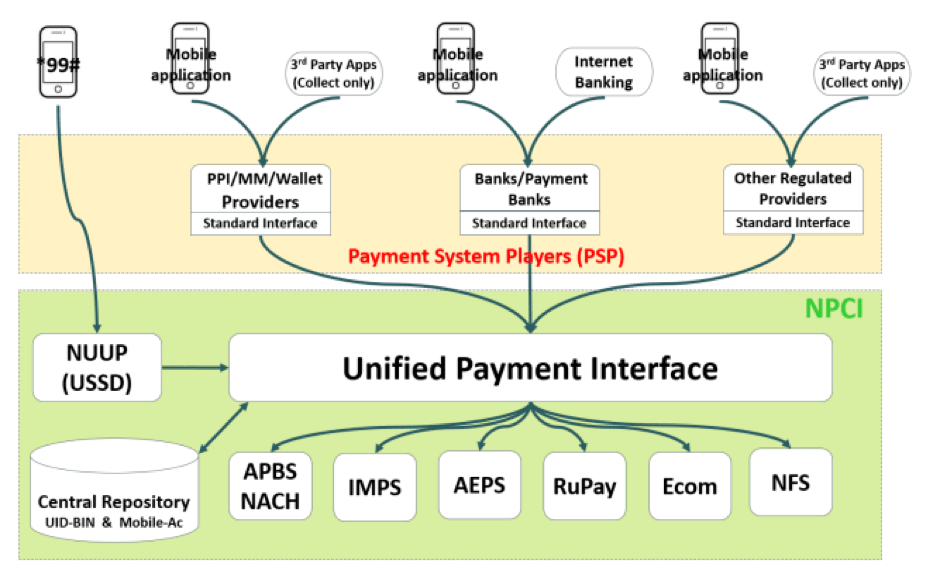

The originator of Unified Payments Interface (UPI) System – NPCI’s (National Payments Corporation of India) aim is to create an ecosystem of UPI enabled services. These include-

- Peer to peer money transfer by providing an address without having to give away or use bank account details. It currently supports four types of user authentications that the payer bank can utilize- aadhar (India’s version of the social security number), IFSC, Mobile No. and NPCI’s Rupay debit cards.

- Supports both push and pull based payment protocols, allowing for both ‘pushed’ payments and ‘pulled’ collections. The architecture of UPI also enables snoozing and reminders for payments, creating a superior user experience for both the payer and payee.

- Unlike the West, India has been significantly lagging in auto debit based transactions. UPI facilitates pre-authorizated recurring payments which are expected to give a much needed fillip to utility payments and subscriptions on ecommerce websites.

- Remittances- India’s booming labour market stands to benefit the most from the proliferation of cheap, high quality smartphones (<100 USD) and cheaper data packs in India. This has created an ecosystem ripe for an innovative approach focused on simplicity of peer to peer payments.

For ecommerce players the option to split and snooze payments will be a good way to approach customers who can’t access credit card based EMIs but would still like to pay in instalments. UPI will see a full rollout in the next few weeks and It will be worthwhile to see how vanilla payment providers such as Freecharge and Paytm will respond to the open-ended API model that UPI pushes for.

Image: Unified Payments Interface System (UPI) Overview

Source: National Payments Corporation of India (NPCI)