E-commerce Regulations in India: More pain than power!

Earlier this week the Department of Industrial Policy and Promotion (DIPP) came out with guidelines allowing for 100 percent Foreign Direct Investment (FDI) in online retail of goods and services.

While this move was expected to bring cheer to the sector that has lately been constrained with funding and valuation challenges, it might prove to be the proverbial ‘one step forward and two steps backward’ case for ecommerce in India.

The new rules stipulate that marketplaces (essentially the model being followed by leading ecommerce players like Amazon, Flipkart and Snapdeal) cannot offer discounts, even through circuitous methods such as Amazon’s ‘promotional funding’, Flipkart’s ‘seller incentives’ and Snapdeal’s ‘promotional expenses’. In a price conscious market like India, if the ecommerce companies are unable to offer discounts, it might deliver a body blow to consumer adoption of ecommerce for shopping. Understandably, the government’s push to bring online commerce at par with offline retail is going to be a difficult pill for the e-commerce companies to swallow.

The move that is expected to have a greater negative impact on ecommerce players is the stipulation to restrict sales from a single vendor on the ecommerce marketplace platform to twenty five percent of the total sales on the platform. These will create interesting challenges for the following reasons:

- Currently Flipkart and Amazon- India’s top two e-tailers have a substantial portion of their revenues originating from WS Retail and Cloudtail respectively. In 2014, Flipkart’s erstwhile subsidiary WS Retail accounted for over 70% of total sales, a figure that has come down but continues to be much higher than 25% stipulation. On the other hand, Cloudtail, a JV between Amazon.com and Catamaran Ventures, generates more than 40 percent of Amazon India’s sales. Given the close nature of the relationship between the ecommerce players and these retailers, the stipulation will create a huge dent in their strategies.

- Even genuine sellers or vendors on the platform, especially those which specialize in high value items like furniture, electronics, jewellery etc. would see their growth on the digital channels being artificially capped due to the new stipulations.

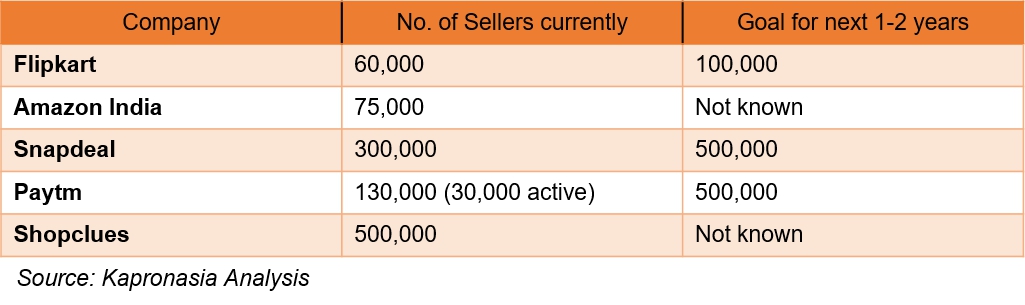

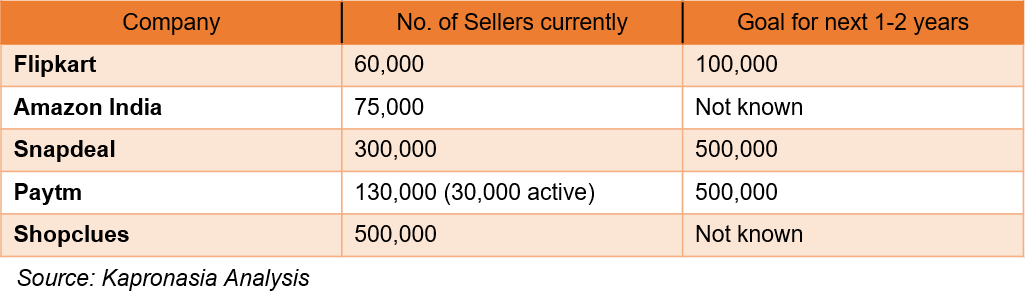

- This stipulation is likely to force a breakup of the larger sellers into smaller ones, each of which will have a narrow focus area or specialization. Interestingly, smaller sellers too might need to consolidate to stay competitive, which could lead to strategic alliances amidst mid-sized seller groups. Perhaps players like Shopclues, Snapdeal and Alibaba backed Paytm figured this out earlier and rightly targeted gaining maximum number of sellers.

Besides the recent regulations from the Central government, a number of state governments in India are attempting to implement or are in the process of implementing an ecommerce tax. Ecommerce companies will have to prepare for a long fight both at the Centre and the State.