Integration is winning the payments race in India

The payments space in India is heating up. Smaller players are looking at exits through consolidation into bigger players. The bigger players have challenges of their own.

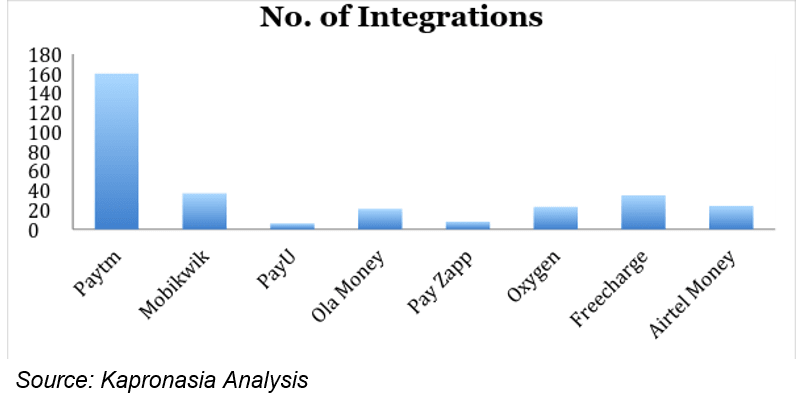

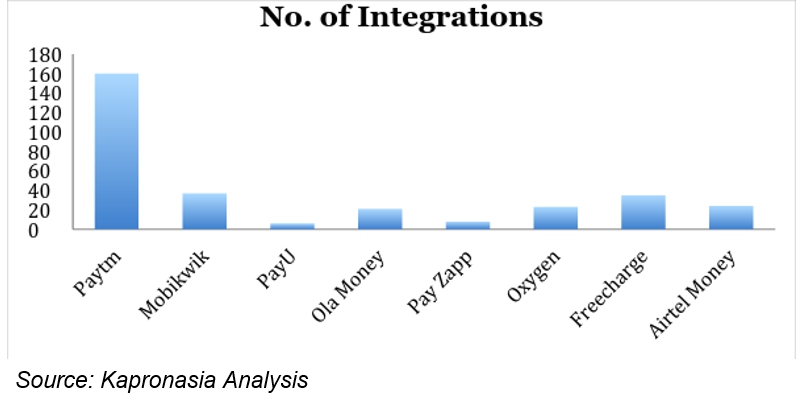

They are looking at viable business models, squeezed for funding on one hand and competitive pressures of acquiring market share on the other. Interestingly, the race is being decided not necessarily by the quality of product or services, but by the alliances or integrations that the payments company is able to notch up. Clearly the integrations are helping crystallize leaders, as payments providers work on a two pronged strategy vis-à-vis integrations:

- Ensure ubiquity: Payments providers are working hard to ensure availability of services across all types of e-commerce and digital platforms. The leaders are tied into Indian Railways (the most daily trafficked website in India) on one hand, and to schools across the country on the other. They have incentivized the various e-commerce platforms to partner with them either through attractive cash back schemes (their investment into customer acquisition) or through almost negligible transaction charges. The leading payments providers are focused on ensuring that the customer transacts through them every time she chooses to make an online purchase.

- Cross leverage customer data: Once a customer registers for a wallet and makes a transaction on a certain e-commerce platform for a product or service, she enables the payments provider with insights that can be leveraged to push her to complete transactions at other e-commerce platforms in the future. This in turn, helps the payments provider to create a loyalty program that works across participating or integrated platforms. It also enables the intermediary platforms to leverage on the deep data sets and consequent analytics of the payments provider. Hence, more partners choose payments providers who provide analytics based insights (of course without compromising privacy).

Industry experts believe that this top-down strategy – first integrating with merchants for consequent end consumer acquisition- is a stronger and more sustainable strategy for payment providers in the long run.